The Canadian government voted this Thursday to suspend taxes for the holidays.

This tax relief concerns the federal tax, and the sale of several products and services will be exempted between December 14 and February 15. The scope of application of this measure is available on official government communications.

To learn more, you can read the following information document:

Government information document.

These changes may impact you, and your Odoo configuration may need to be modified to reflect this.

We want to help you navigate this temporary change in your sales and purchases invoicing and accounting: we have already started taking steps to make it easier for our customers to implement this measure.

We invite you to contact your project manager to establish an action plan if you are affected by these measures, targeting ''holiday groceries and essential products''. We will be happy to help you navigate this 2024 holiday season.

You can use the contact form, or directly contact your preferred contact at Arche TI.

If you want to make the changes yourself, here is the procedure to follow.

You will have to work in two different places, to apply the different necessary changes.

The products on one side, to remove the GST from the taxes applied to the corresponding products, and for purchases you will have to modify the parameters of the impacted suppliers.

You will of course have to roll back these changes at the end of the tax holiday to put everything back in order.

Modify taxes on a product

The principle will be to not apply the GST on eligible products. You must therefore enter the product configuration and deactivate this tax.

Here's the procedure:

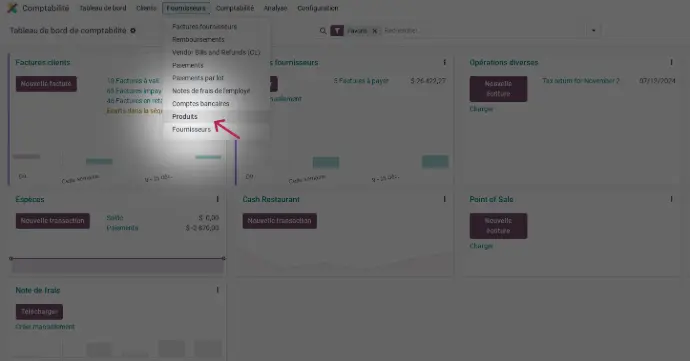

1 -

Products can be accessed from the accounting module.

2 -

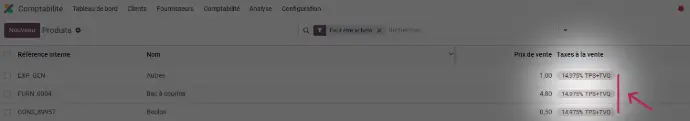

Follow this path:

Acounting / Supliers / Products

3 -

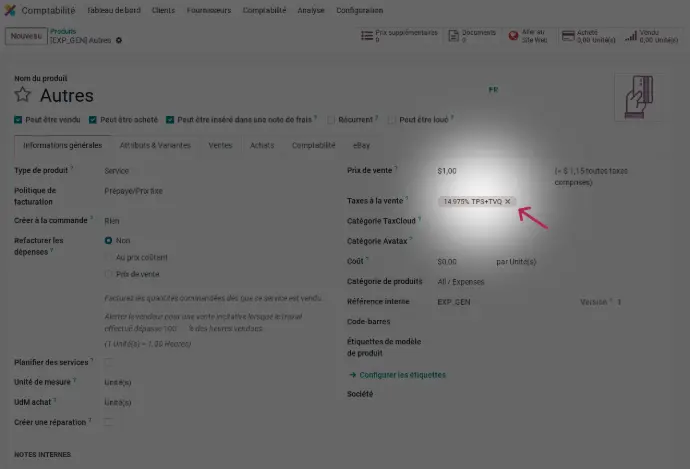

We can see the applied taxes on each product.

4 -

We can change the tax py clicking

on the product to be modified.

5 -

You should have in your settings, the option to choose only the QST.

The GST is now removed from the product when it is sold.

Modify invoice settings

For purchases, you need to modify the application of taxes on your incoming invoices, and this will be done in the configuration of each invoice.

Here are the steps:

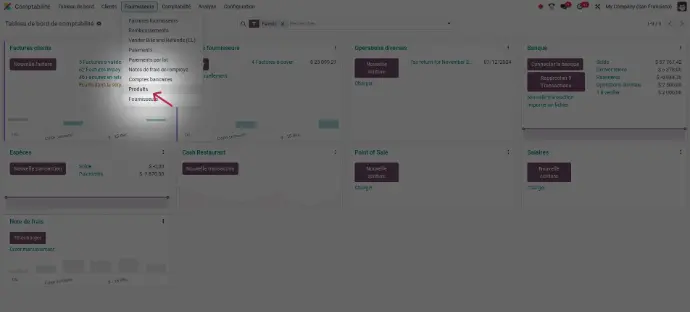

1 -

To modify the taxes on your purchased products, go back to the products tab.

2 -

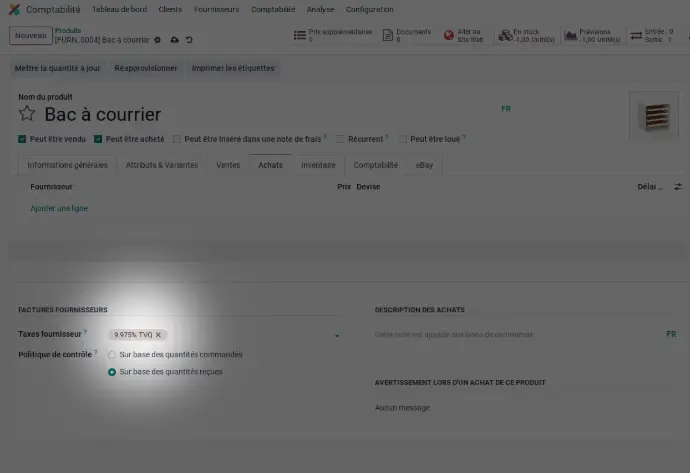

After selecting a product, click on the [Purchase] tab and look for the supplier tax.

3 -

You should have in your settings, the option to choose only the QST.

The GST is now removed from the product when it is purchased.

Modify multiple products via an export-import

It is very likely that several of your products are targeted by this tax break. It will quickly become unthinkable to modify each product one by one... you won't be finished before February 15!

To avoid this, we can obviously configure several products at once, using a database import. It may be preferable to export the list of products concerned to be sure to have them all, then modify the parameter in the database then create and reimport it to apply the changes.

If you are not comfortable with this type of manipulation, it is probably preferable to contact our team at Arche TI, who will help you make the right choice and ensure the proper continuity of your operations.

Don't forget to prepare for the return to normal

This is a temporary tax holiday, so you need to reactivate taxes at the end of the established period. It is not natively possible to prepare an automatic function to do this, and you will have to go back and repeat the steps in reverse.

We recommend that you keep a copy of the lists and databases used to make the changes, as you will use them for the same purposes

We suggest you:

- Replace all normal taxes on the products,

- Check that everything is back in order by doing one or two tests.

In summary

You must therefore deactivate the federal tax during the period in question, both on your products for sale and for your purchases. Since you will have to reactivate the normal tax application afterwards, make sure to keep a list of the modified items, so that you can more quickly come back to them and restart the GST at the end of the measure.

If you have any difficulty making these changes, or if you are not sure if you have all the information in hand, know that you can always count on Arche TI

![Une fois avoir sélectionné un produit, on sélectionne l’onglet [Achats] et on peut voir au bas la taxe fournisseurs appliquée. Une fois avoir sélectionné un produit, on sélectionne l’onglet [Achats] et on peut voir au bas la taxe fournisseurs appliquée.](/web/image/411405-b2f436d4/ab.webp?access_token=f4060d33-203e-4ff1-8ae3-84f9f028fb8e)

A tax break for the Holiday